PH BIR 1801 2018-2026 free printable template

Show details

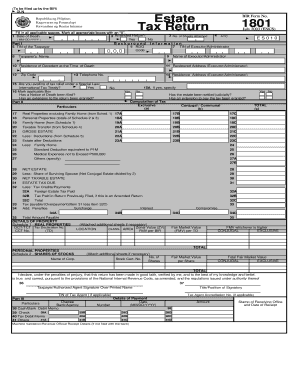

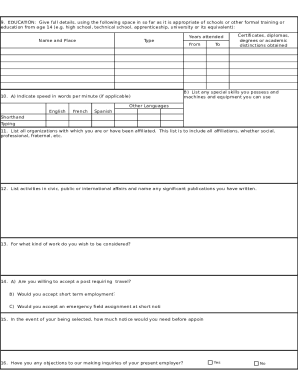

00 Judicial Expenses of the Testamentary or Intestate Proceedings/Administration Expenses Claims against the Estate Unpaid Mortgages Property Previously Taxed Vanishing Deduction Transfers for Public Use ESTATE TAX TABLE If the Net Estate is Over 200 000 But Not Over The Tax Shall Be Exempt 15 000 Plus Of the Excess Over 5 000 000 10 000 000 and over BIR FORM NO. 1801 - ESTATE TAX RETURN Guidelines and Instructions 465 000 Who Shall File This return shall be filed in triplicate by 1. To be...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1801 bir form

Edit your bir form 1801 download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1801 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir form 1801 online online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 1801 bir. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1801 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir 1801 form

How to fill out PH BIR 1801

01

Obtain a copy of the BIR Form 1801 from the Bureau of Internal Revenue (BIR) website or your local BIR office.

02

Fill in your Taxpayer Identification Number (TIN) in the designated field at the top of the form.

03

Indicate the tax year for which you are filing the form.

04

Provide your name, address, and contact details in the appropriate sections.

05

Specify the type of income and provide details of your taxable income for the period.

06

Calculate the total tax due according to the instructions provided on the form.

07

Sign and date the form at the bottom to authenticate your submission.

08

Submit the completed form to the nearest BIR office or file it electronically if applicable.

Who needs PH BIR 1801?

01

Individuals or entities earning income in the Philippines who are required to file income tax returns.

02

Self-employed individuals and freelancers who need to report their income.

03

Corporations, partnerships, and other business entities that generate taxable income.

Fill

bir form 1801 estate tax return

: Try Risk Free

People Also Ask about bir form 1801 estate tax

How much is inheritance tax in Philippines?

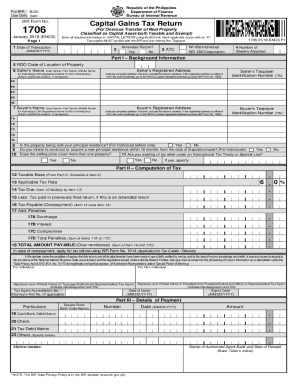

There is no inheritance tax in the Philippines. However, an estate tax of 6% is imposed on the assets of the decedent taxpayer. Free acquisition of goods by individuals (inheritance and gifts) is taxed under the stamp tax at 10%.

What is Form 1801?

Fair Market Value. Guidelines and Instructions. BIR FORM NO. 1801 - ESTATE TAX RETURN.

What is a DD Form 1801?

ForeFlight Military Flight Bag pilots can now file flight plans using the military's official DD-1801 filing form directly through ForeFlight, greatly simplifying their preflight workflow and reducing reliance on paper.

Where do I file a 1801?

This return shall be filed with any Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the place of domicile of the decedent at the time of his death.

How to fill out an 1801 flight plan?

0:47 3:50 ForeFlight How-To: Military Flight Bag DD-1801 Filing - YouTube YouTube Start of suggested clip End of suggested clip Field. Then review the rest of the form and add any required. Information the emergency andMoreField. Then review the rest of the form and add any required. Information the emergency and additional information sections in particular are different with the DD 1801.

What is the purpose of BIR Form 1801?

The Estate Tax Return (BIR Form 1801) shall be filed within one (1) year from the decedent's death. In meritorious cases, the Commissioner shall have the authority to grant a reasonable extension not exceeding thirty (30) days for filing the return.

What is item 13 on DD Form 1801?

13. Departure Aerodrome- “KNPA”, use the 4 letter identifier for the airfield that you are departing from. If the Airfield contains a number or no LOCID is assigned, enter “ZZZZ” in block 13.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get bir 1801 online?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific bir form 1801 pdf download and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit form 1801 estate tax return in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing bir form no 1801 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete estate tax return form 1801 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your bir estate tax amnesty return form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is PH BIR 1801?

PH BIR 1801 is a tax form used in the Philippines for the declaration of income derived from the sale of shares of stock not traded on the stock exchange.

Who is required to file PH BIR 1801?

Individuals or entities who engage in the sale of stock from sources in the Philippines, which are not traded on any local stock exchanges, are required to file PH BIR 1801.

How to fill out PH BIR 1801?

To fill out PH BIR 1801, taxpayers must provide personal information, details about the sale of shares, and calculate the corresponding tax due based on the net income from the sale.

What is the purpose of PH BIR 1801?

The purpose of PH BIR 1801 is to report and pay taxes on income derived from the sale of shares of stock not traded on stock exchanges, ensuring compliance with Philippine tax laws.

What information must be reported on PH BIR 1801?

The information that must be reported on PH BIR 1801 includes taxpayer identification details, the nature of the transaction, total selling price, cost of shares sold, and the resulting income or loss from the sale.

Fill out your PH BIR 1801 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To File Bir Form 1801 Online is not the form you're looking for?Search for another form here.

Keywords relevant to bir form for estate tax

Related to form 1801 estate tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.